When doing calculations for inventory costs and cost of goods sold, LIFO begins with the price of the newest purchased goods and works backward towards older inventory. When a company selects its inventory method, there are downstream repercussions that impact its net income, balance sheet, and ways it needs to track inventory. Here is a high-level summary of the pros and cons of each inventory method.

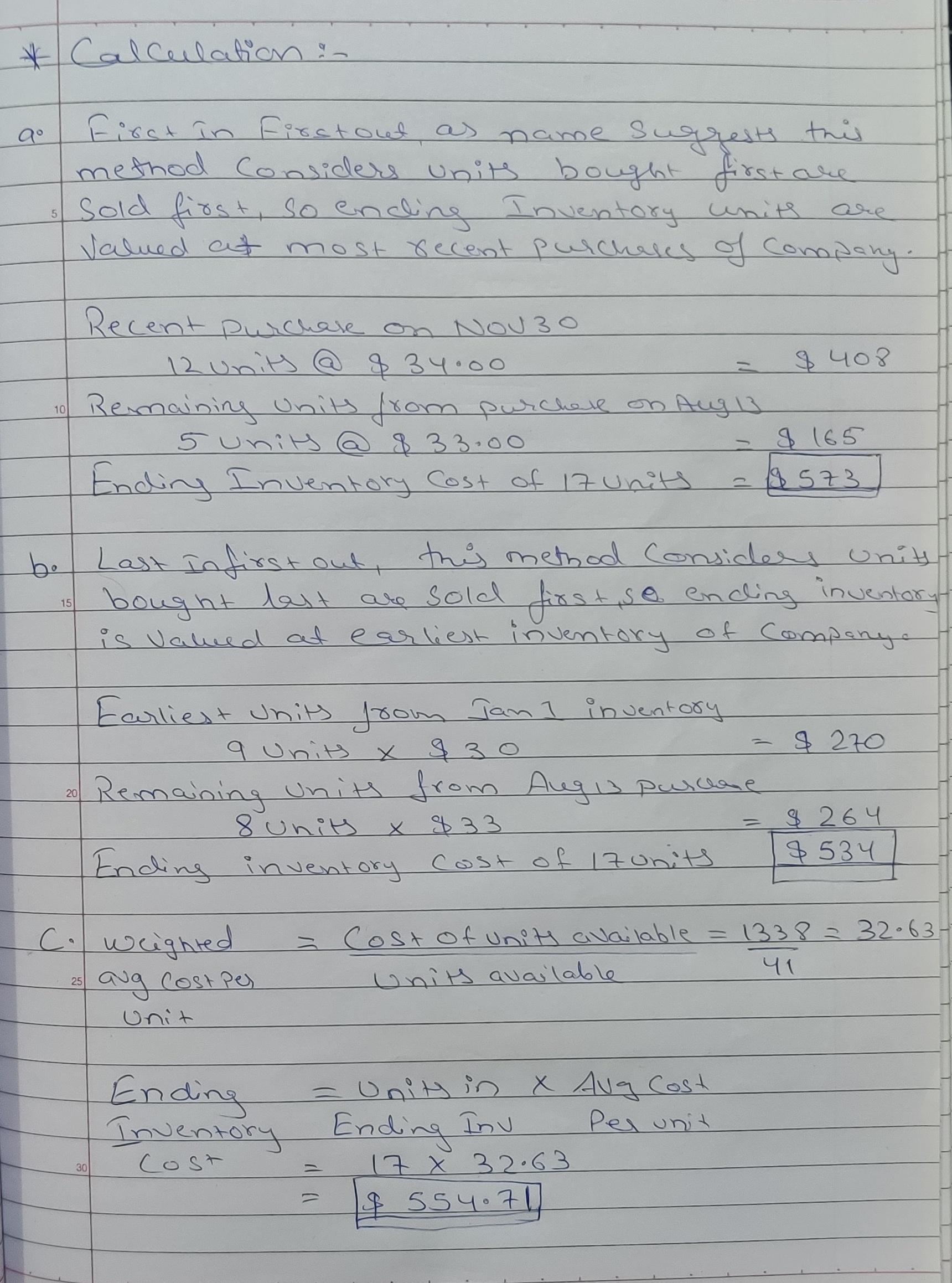

Periodic FIFO

However, the higher net income means the company would have a higher tax liability. When sales are recorded using the LIFO method, the most recent items of inventory are used to value COGS and are sold first. In other words, the older inventory, which was cheaper, would be sold later. In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive. As a result, the company would record lower profits or net income for the period.

How SKU Tracking Can Help Your Business

However, the reduced profit or earnings means the company would benefit from a lower tax liability. For all periodic methods we can separate the purchases from the sales in order to make the calculations easier. Under the periodic method, we only calculate inventory at the end of the period. Therefore, we can add up all the units sold and then look at what we have on hand. When costs are rising, LIFO will give the highest cost of goods sold and the lowest gross profit.

Impact on Financial Reporting

The value of ending inventory is the same under LIFO whether you calculate on periodic system or the perpetual system. LIFO method values the ending inventory on the cost of the earliest purchases. Now that we know that the ending inventory after the six days is four units, we assign it the cost of the most earliest purchase which was made on January 1 for $500 per unit. On the LIFO basis, we will value the cost of 6 3 receivables intermediate financial accounting 1 the shoes sold on the most recent purchase cost ($6), whereas the remaining pair of shoes in inventory will be valued at the cost of the earliest purchase ($5). In this lesson, I explain the easiest way to calculate inventory value using the LIFO Method based on both periodic and perpetual systems. A trading company has provided the following data about purchases and sales of a commodity made during the year 2016.

- So, Lee decides to use the LIFO method, which means he will use the price it cost him to buy lamps in December.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Because of a higher COGS during inflation, LIFO may result in lower reported profits.

- Besides, inventory turnover will be much higher as it will have higher COGS and smaller inventory.

- The remainder of the cost of goods available is reported on the income statement as the cost of goods sold.

- The four paddles present at the beginning of the period at $38 each are still included in inventory at the end of the period.

The company has two groups of inventory – one at $35 per unit and another at $36 per unit. In a periodic LIFO system, inventory records are only updated at the end of a reporting period. Value of ending inventory is therefore equal to $2000 (4 x $500) based on the periodic calculation of the LIFO Method. Let’s calculate the value of ending inventory using the data from the first example using the periodic LIFO technique. The example above shows how inventory value is calculated under a perpetual inventory system using the LIFO method. The reason for organizing the inventory balance is to make it easier to locate which inventory was acquired most recently.

Although the ABC Company example above is fairly straightforward, the subject of inventory and whether to use LIFO, FIFO, or average cost can be complex. Knowing how to manage inventory is a critical tool for companies, small or large; as well as a major success factor for any business that holds inventory. Managing inventory can help a company control and forecast its earnings. Conversely, not knowing how to use inventory to its advantage, can prevent a company from operating efficiently.

It also allows businesses to reduce their tax liability, as higher costs result in lower taxable income. FIFO calculates a lower cost of goods sold, giving a higher gross income and profit. This can make the business look more successful and appealing to investors, but it also comes with a higher tax bill. FIFO assumes a regular inventory turnover, and the remaining inventory has a higher value compared to other inventory valuation methods.

On December 31, 2016, a physical count of inventory was made and 120 units of material were found in the store room. In many cases, customers prefer to have newer goods rather than older products. Particularly if you work in an industry where goods decay over time, using LIFO can ensure that customers receive fresh goods. This can help your business build positive credibility with your customer base. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.